- Published: 28 September 2022

- Written by Editor

Highgold drills 14.8 m of 14.3 g/t AuEq at Johnson

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220928005296/en/

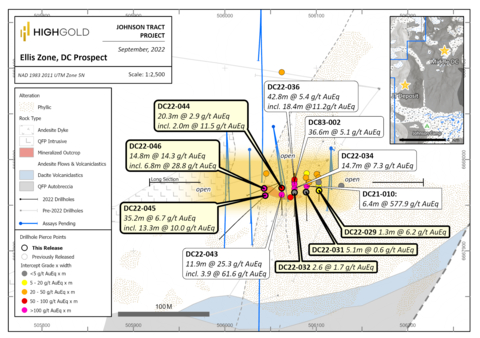

Figure 1. Johnson Tract Project - DC Prospect - Ellis Zone Plan Map with Drill Hole Locations (Graphic: Business Wire)

Ongoing diamond drilling continues to focus on the Ellis Zone where step-out drilling on 25 meter centres has returned strong mineralization west and down-dip of recently released hole DC22-043 with 21.68 g/t Au, 30 g/t Ag, 0.61% Cu, 4.20% Zn over 11.9 meters (See HighGold press release dated September 12, 2022). The new intersections have expanded the footprint of the wide, high-grade Ellis Zone mineralization by nearly 50% and the zone remains open in all directions.

Drill Highlights of the Ellis Zone, DC Prospect

Drillhole DC22-046

-

14.8m @ 10.14 g/t Au, 13.8 g/t Ag, 0.28% Cu, 5.97% Zn (14.3 g/t AuEq)including

- 6.8m @ 21.29 g/t Au, 25.1 g/t Ag, 0.55% Cu, 0.61% Pb, 10.70% Zn (28.7 g/t AuEq) including

- 1.5m @ 62.50 g/t Au, 10.5 g/t Ag, 0.77% Cu, 0.59% Pb, 10.59% Zn (70.0 g/t AuEq)

Drillhole DC22-045

-

35.2m @ 4.2 g/t Au, 6.1 g/t Ag, 0.12% Cu, 1.40% Pb, 3.19% Zn (6.7 g/t AuEq)including

- 1.9m @ 12.95 g/t Au, 37.7 g/t Ag, 13.51% Pb, 31.42% Zn (36.2 g/t AuEq), and

- 13.3m @ 7.81 g/t Au, 6.4 g/t Ag, 0.23% Cu, 1.31% Pb, 2.35% Zn (10.0 g/t AuEq)

Drillhole DC22-044

-

20.3m @ 1.72 g/t Au, 5.6 g/t Ag, 0.14% Cu, 1.46% Zn (2.9 g/t AuEq), in hole DC22-044,including

- 2.0m @ 8.34 g/t Au, 8.9 g/t Ag, 0.41% Cu, 4.00% Zn (11.5 g/t AuEq)

"The Ellis Zone discovery continues to deliver excellent results with some of the strongest and widest intersections to date coming from the western limit of our drilling," commented Darwin Green, CEO. "We are very encouraged by the persistence of the Ellis Zone mineralization along strike and plan to keep stepping out in all directions as we continue expanding the known extents of the zone. While still very early days, it appears we are well on our way to defining a second deposit at Johnson Tract to compliment the existing high-grade +1Moz JT Deposit mineral resource that is also open to expansion."

Discussion of DC Prospect and Ellis Zone Drill Results

The DC Prospect is located four (4) kilometers northeast of the JT Deposit and is characterized by a series of large gossan alteration zones similar in style to the +1Moz AuEq JT Deposit that collectively extend over a 1.5 km x 3.0 km area in a broad northeasterly trend. Gold mineralization and pervasive clay/anhydrite alteration are preferentially developed within dacitic to rhyolitic fragmental rocks that are capped by a shallowly-dipping sequence of lesser altered andesite volcanics that are host to a gold- and silver-rich epithermal vein field at higher elevations. The widespread extent of mineralization exposed in erosional windows through the capping andesite supports potential for a large and partially blind mineralized system linking the various DC Prospect zones together over a strike length of 3 km. Drilling in late 2021 resulted in the discovery of near-surface bonanza-grade mineralization, which returned 577.9 g/t Au and 2,023 g/t Ag over 6.40 meters in hole DC21-010. Subsequent geological modeling during the off-season inferred an east-west striking, steeply north-dipping trend to the mineralization that became the focus for the initial 2022 drill program at what is now referred to as the 'Ellis Zone'.

To date, a total of 36 drill holes for4,935 meters have been completedat the Ellis Zone since the start of the summer season. Today's news release includes assay results for six (6) new holes, bringing the total number of holes released to date to 14. Drill hole lengths typically range from 75 to 150 meters and have been completed as fans of holes in a close-spaced 12.5 to 25-meter grid pattern with the objective of further refining the geometry, geological controls, and grade distribution of this promising new mineralized zone. Mineralogy, veining and alteration are similar to the main JT Deposit, located four (4) km to the southwest, which has been defined from surface to a vertical depth of more than 300 meters, over a strike length of 600 meters and has an average true thickness of 40m.

Drilling to date has now defined the Ellis Zone mineralization over a strike length of approximately 125 meters and from surface to a depth of 100 meters with an average true thickness of 10 to 15 meters. An apparent shallow plunge to the southwest is now defined by thickest and the highest-grade intercepts. The Ellis Zone remains open along strike and at depth and drilling continues to step-out along to the east and west in ever increasing increments as confidence in the geological model improves.

Details of the locations of 2022 drill holes completed so far can be found in Figures 1 and 2 with key assay intersections displayed in Table 1.

2022 Exploration Program Update

The 2022 Drilling and Exploration Program includes diamond drilling (two rigs), geological mapping, geochemical sampling, airborne drone-magnetic geophysical surveying, preliminary environmental and engineering baseline studies, and general JT camp improvements. Drilling is expected to wrap up in mid to late-October with a total of 10,000 to 11,000 meters completed. To September 23rd, a total of 8,230 meters have been completed in 47 holes (36 at the DC prospect, six (6) at the Milkbone prospect, one (1) at the Kona prospect, and four (4) at the JT Deposit area). For the remainder of the drill program one drill rig will continue to focus on expanding the Ellis Zone while the second drill rig will test important resource growth targets at the main JT Deposit, one of the other core priorities for the 2022 drill season. Assays results will be released on an ongoing basis pending review and meeting Company quality assurance-quality control protocols.

Table 1. Johnson Tract Project - DC Prospect - Ellis Zone - Significant Assay Intersections

|

Drill Hole |

From |

To |

Length |

Au |

Ag |

Cu |

Pb |

Zn |

AuEq |

|

(meters) |

(meters) |

(meters) |

(g/t) |

(g/t) |

% |

% |

% |

(g/t) |

|

|

DC22-029 |

31.3 |

32.6 |

1.3 |

6.10 |

6.5 |

0.01 |

0.02 |

0.04 |

6.2 |

|

DC22-031 |

29.2 |

34.3 |

5.1 |

0.31 |

6.7 |

0.03 |

0.10 |

0.23 |

0.6 |

|

DC22-032 |

28.0 |

30.6 |

2.6 |

0.24 |

3.2 |

0.10 |

0.59 |

1.96 |

1.7 |

|

And |

51.1 |

55.6 |

4.5 |

0.26 |

10.2 |

0.11 |

0.90 |

2.56 |

2.3 |

|

DC22-044 |

46.4 |

66.7 |

20.3 |

1.72 |

5.6 |

0.14 |

0.18 |

1.46 |

2.9 |

|

Incl |

52.8 |

54.8 |

2.0 |

8.34 |

8.9 |

0.41 |

0.44 |

4.00 |

11.4 |

|

DC22-045 |

4.6 |

57.1 |

52.5 |

2.95 |

5.5 |

0.10 |

1.01 |

2.38 |

4.9 |

|

Incl |

9.1 |

44.3 |

35.2 |

4.20 |

6.1 |

0.12 |

1.40 |

3.19 |

6.7 |

|

Incl |

9.1 |

11.0 |

1.9 |

12.95 |

37.7 |

0.08 |

13.51 |

31.42 |

36.2 |

|

Incl |

30.0 |

43.3 |

13.3 |

7.81 |

6.4 |

0.23 |

1.31 |

2.35 |

10.0 |

|

DC22-046 |

56.0 |

70.8 |

14.8 |

10.14 |

13.8 |

0.28 |

0.46 |

5.97 |

14.3 |

|

Incl |

56.0 |

65.7 |

9.7 |

15.34 |

20.0 |

0.42 |

0.60 |

8.58 |

21.3 |

|

Incl |

57.5 |

64.3 |

6.8 |

21.29 |

25.1 |

0.55 |

0.61 |

10.70 |

28.7 |

|

Incl |

57.5 |

59.0 |

1.5 |

62.50 |

10.5 |

0.77 |

0.59 |

10.50 |

70.0 |

True thickness for the reported intersections estimated at 50% to 90% of reported width. Gold Equivalent ("AuEq") based on assumed metal prices of US$1650/oz for Au, US$20/oz for Ag, US$3.50/lb for Cu, US$1.00/lb for Pb and US$1.50/lb for Zn and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn.

About the Johnson Tract Gold Project

Johnson Tract is a polymetallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of Anchorage, Alaska, USA. The 21,000-acre property includes the high-grade Johnson Tract Deposit ("JT Deposit") and at least nine (9) other mineral prospects over a 12-kilometer strike length. HighGold acquired the Project through a lease agreement with Cook Inlet Region, Inc. ("CIRI"), one of 12 land-based Alaska Native regional corporations created by the Alaska Native Claims Settlement Act of 1971. CIRI is owned by more than 9,100 shareholders who are primarily of Alaska Native descent.

Mineralization at Johnson Tract occurs in Jurassic intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body averaging 40m true thickness that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration. The Footwall Copper Zone is located structurally and stratigraphically below JT Deposit and is characterized by copper-silver rich mineralization.

The JT Deposit hosts an Indicated Resource of 3.489 Mt grading 9.39 g/t gold equivalent ("AuEq") comprised of 5.33 g/t Au, 6.0 g/t Ag, 0.56% Cu, 0.67% Pb and 5.21% Zn. The Inferred Resource of 0.706 Mt grading 4.76 g/t AuEq is comprised of 1.36 g/t Au, 9.1 g/t Ag, 0.59% Cu, 0.30% Pb, and 4.18% Zn. For additional details see NI 43-101 Technical Report titled "Updated Mineral Resource Estimate and NI 43-101 Technical Report for the Johnson Tract Project, Alaska," dated August 25, 2022 (effective date of July 12, 2022) authored by Ray C. Brown, James N. Gray, P.Geo. and Lyn Jones, P.Eng. Gold Equivalent ("AuEq") is based on assumed metal prices and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn from metallurgical testwork completed in 2022. Assumed metal prices for the Resource are US$1650/oz for gold (Au), US$20/oz for silver (Ag), US$3.50/lb for copper (Cu), US$1.00/lb for lead (Pb), and US$1.50/lb for zinc (Zn).

Prior to HighGold, the Project was last explored in the mid-1990s by a mid-tier mining company that evaluated direct shipping material from Johnson to the Premier Mill near Stewart, British Columbia.

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in North America. HighGold's flagship asset is the high-grade Johnson Tract Gold (Zn-Cu) Project located in accessible Southcentral Alaska, USA. The Company also controls one of the largest junior gold miner land positions in the Timmins, Ontario gold camp. This includes the Munro-Croesus Gold property, which is renowned for its high-grade mineralization, and the large Golden Mile and Golden Perimeter properties. HighGold's experienced Board and senior management team, are committed to creating shareholder value through the discovery process, careful allocation of capital, and environmentally/socially responsible mineral exploration.

Ian Cunningham-Dunlop, P.Eng., Senior VP Exploration for HighGold Mining Inc. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

On Behalf of HighGold Mining Inc.

"Darwin Green"

President & CEO

Additional Notes :

Starting azimuth, dip and final length (Azimuth/-Dip/Length) for the six drill holes reported today are noted as follows: DC22-029 (180/50/50.2m), DC22-031 (180/48/76.7m), DC22-032 (180/51/73.7m), DC22-044 (180/85/95.4m), DC22-045 (230/45/132.8m), and DC22-046 (245/70/126.3m).

Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and the remaining half of the cut core placed back in the original core box for permanent storage, on site. Sample lengths range from a minimum 0.5-meter to a maximum 2.0-meter interval, with an average sample length of 1.0 to 1.5 meter.

The half-cut core samples are then dried for 1-2 days at 50-60 degrees Celsius, crushed to 2mm (>70%) and pulverized to 75 microns (>85%) at the Company's new onsite sample preparation facility. The preparation facility was designed under the guidance of expert third party consultant, Dr. Barry Smee, P.Geo. Sample pulps are individually packaged in paper envelopes and weigh approximately 250 grams each, the sample pulps are then placed inside security-strapped plastic totes in batches of 80-100 samples per tote with each tote weighing about 22-23 kilograms. The samples are then shipped by air freight directly to ALS Geochemistry Analytical Lab facility in North Vancouver, BC for analysis.

Gold is determined by fire-assay fusion of a 50-gram sub-sample with atomic absorption spectroscopy (AAS). Samples that return values >10 ppm gold from fire assay and AAS are determined by using fire assay and a gravimetric finish. Various metals including silver, gold, copper, lead and zinc are analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead and zinc are determined by ore grade assay for samples that return values >10,000 ppm by ICP analysis. Silver is determined by ore grade assay for samples that return >100 ppm. ALS Geochemistry meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. ALS Global operates according to the guidelines set out in ISO/IEC Guide 25.

The Company maintains a robust QAQC program that includes the collection and analysis of duplicate samples and the insertion of blanks and standards (certified reference material). The Company's database and QAQC data have been audited by two independent, external experts, Chris Brown of Oriented Target Solutions LLC and Barry Smee of Smee and Associated Consulting Ltd

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking statements: This news release includes certain "forward-looking information" within the meaning of Canadian securities legislation and "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively "forward looking statements"). Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's further 2022 drill plans and future results at the Johnson Tract Project are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company's expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220928005296/en/

Contacts:

For further information, please visit the HighGold Mining Inc. website at www.highgoldmining.com, or contact:

Darwin Green, President & CEO or Naomi Nemeth, VP Investor Relations

Phone: 1-604-629-1165 or North American toll-free 1-855-629-1165

Email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Website: www.highgoldmining.com

Twitter : @HighgoldMining

Source: HighGold Mining Inc.