- Published: 19 March 2021

- Written by Editor

Prime Mining Extends Bonanza Grade Gold-Silver Mineralization 150 Metres Below Previous Drilling in Estaca Vein

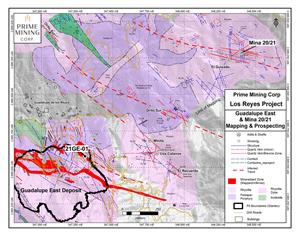

- New surface mapping and sampling at Mina 20/21 resulted in the discovery of an area of unrecorded historic mining. Chip sampling of adularia bearing banded quartz veins and quartz breccias returned several mineralized intervals including 2.3 m at 29.8 gpt Au and 1,132 gpt Ag.

- The relative elevations of mineralization in drilling at Guadalupe and in sampling at Mina 20/21 suggest the bonanza grade epithermal column extends over 500 m in vertical height.

Chief Executive Officer, Daniel Kunz commented “Our first Guadalupe East drill hole opens up impressive bonanza-grade gold-silver potential at Los Reyes and highlights the expanding potential at depth and to the east at Guadalupe. Recognition of the San Nicolas vein at shallow depths and below the current pit boundary offers significant pit expansion opportunities, while the newly sampled bonanza grade mineralized structures in an area known as Mina 20/21 may lead Prime to discover more mineral deposit areas.”

Figure 1: https://www.globenewswire.com/NewsRoom/AttachmentNg/9a2a39d3-edad-4e8c-9aeb-dadcce2f89fc

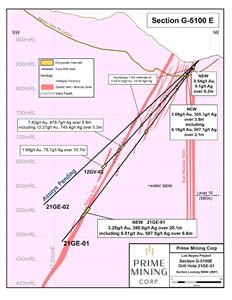

The Estaca Vein

The Estaca vein is one of two principal veins mined at Guadalupe East and remains largely untested by drilling. Historic drill campaigns established limited understanding of the true orientation of the vein. Only three of more than a dozen drill holes intersected the bonanza-style mineralization previously mined at Guadalupe (see Table 1). Current 3D modelling and re-interpretation of these drill intersections indicates a steep southwest dipping vein geometry explaining why previous efforts failed to intersect the structure. This interpretation also indicates that the true width of the vein intercept in 21GE-01 is approximately 30-40% of the reported drill hole intercept. Mineralization is typical of low sulphidation epithermal zones, comprising massive to drusy, colliform to crustified adularia bearing quartz and quartz breccias.

Follow up drilling is now targeting the main structure which is open at depth and along strike. The structure will also be targeted up dip and along strike in several areas where significant gaps remain between historic development. Recognition of the controlling structure and the significant height of the boiling zone containing bonanza grades provides opportunity for new, high-grade underground resource areas.

The San Nicolas Vein

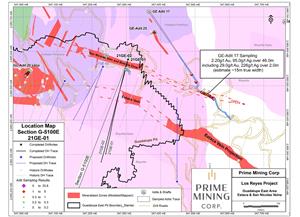

Hole 21GE-01 also intersected the San Nicolas vein near surface and 80 m from the closest historic drilling. This intercept is located just below the eastern limit of the current pit-constrained Guadalupe East deposit resource (see Figures 2 and 3). Two shallow historic drill holes (located 80 m northwest) within the current Guadalupe East resource also carried similar grades and are the only two known drill holes to have intersected the San Nicolas vein (see Table 1). Further drilling in this area below the current pit has the potential to increase the open pit resource of the Guadalupe East deposit.

Figure 2: https://www.globenewswire.com/NewsRoom/AttachmentNg/62b32549-456d-4bd9-80cb-1d1969982cf0

The San Nicolas vein is steeply dipping, open along strike and down dip and demonstrates gold-silver grades with underground resource potential. The vein may have been sampled in late 2020 where GE-Adit 17 returned 46 m at 2.20 gpt Au and 95.0 gpt Ag, including 2 m at 29.0 gpt Au and 226.0 gpt Ag (see Prime news release dated October 10, 2020). The zone at GE-Adit 17 is 235 m east of the San Nicolas intersection in hole 21GE-01.

Table 1: Relevant Estaca and San Nicolas and Vein Intercepts

| Estaca Vein | |||||

| Hole ID | From (m) | To (m) | Interval (m) | Au (gpt) | Ag (gpt) |

| New Data | |||||

| 21GE-01 | 380.0 | 400.1 | 20.1 | 3.25 | 380.0 |

| Incl. | 393.5 | 400.1 | 6.6 | 6.51 | 587.5 |

| Historic Data | |||||

| 12GV-02 | 236.3 | 245.2 | 8.9 | 7.83 | 479.7 |

| Incl. | 239.9 | 245.2 | 5.3 | 12.27 | 745.4 |

| 12GV-03 | 132.9 | 137.5 | 4.7 | 2.22 | 161.5 |

| GE062 | 190.8 | 224.0 | 33.2 | 3.88 | 171.4 |

| Incl. | 216.4 | 224.0 | 7.6 | 7.62 | 376.2 |

| San Nicolas Vein | |||||

| New Data | |||||

| 21GE-01 | 37.4 | 41.2 | 3.8 | 3.69 | 305.1 |

| Incl. | 37.4 | 39.5 | 2.1 | 6.18 | 507.1 |

| Historic Data | |||||

| GS058 | 57.9 | 59.4 | 1.5 | 21.08 | 507.5 |

| 11GV-01 | 55.0 | 57.0 | 2.0 | 14.95 | 456.7 |

| *all intersections are core lengths | |||||

Mapping and Prospecting Finds New Bonanza Grade Structures

Field work over the last three months has rediscovered several historic adits containing several gold-silver mineralized structures located 1.3 km northeast of the Guadalupe East deposit. These adits are believed to have been mined in the early 1900s and are not recorded on any “modern” exploration maps (see Figure 3). One area, referred to as Mina 20/21, 1.3 km northeast of Guadalupe East, and 500 m from the original Los Reyes eastern property boundary, has evidence of historic small-scale mining and gold-silver extraction. Surface and underground sampling in Mina 20/21 returned 42 chip sample assay results ranging 0.015gpt to 29.8 gpt Au and 0.5 gpt to 1,132 gpt Ag with the best chip assay returning 2.3 m at 29.8 gpt Au and 1,132 gpt Ag (see Table 2).

Table 2: Mina 20/21 Area Selected Sampling Results

| Samples | Elevation | Type | Length | Structure | Au (gpt) | Ag (gpt) |

| LRC-2157 | 1080m | Chip* | 2.30m | 100° / 50° NE | 29.8 | 1132 |

| LRC-2186 | 1008m | Dump Rock Grab | 20.7 | 339 | ||

| LRC-2151 | 1076m | Chip* | 1.5m | 60 ° / 70° NW | 14.0 | 644 |

| LRC-2153 | 1076m | Chip* | 0.9m | 62 ° / 70° NW | 6.9 | 259 |

| LRC-2156 | 1080m | Chip* | 1.30m | 100° / 50° NE | 5.4 | 191.8 |

| LRC-2152 | 1076m | Chip* | 1.80m | 100 ° / 35°NE | 3.2 | 155.8 |

| LRC-2158 | 1080m | Float* | 1.9 | 247 | ||

| LRC-2192 | 1083m | Float | 0.5 | 1.1 | ||

| LRC-2171 | 1063m | Chip | 1.10m | 310°/55°NE | 0.4 | 15.8 |

| LRC-2182 | 1038m | Chip | 1.70m | 30°/60°SE | 0.4 | 42.4 |

| LRC-2191 | 1084m | Chip | 0.80m | 295°/ 60°NE | 0.4 | 1.2 |

| LRC-2154 | 1080m | Chip | 2.10m | 100° / 57° NE | 0.3 | 3.7 |

| LRC-2193 | 1090m | Chip | 0.80m | 320°/ 65°NE | 0.2 | 1 |

| LRC-2170 | 1053m | Chip | 2.20m | 310°/50°NE | 0.2 | 11.1 |

*Collected within mine adit

Figure 3: https://www.globenewswire.com/NewsRoom/AttachmentNg/e74d6ea8-0839-4a99-bc45-9b097ff71392

Los Reyes Exploration Program Update

To date, Prime has completed 16 diamond drill holes totalling 3,886 m, representing 26% of the planned 15,000 m Phase 1 program. Of these, 9 were drilled in Zapote, 4 in Noche Buena, 2 at Guadalupe and one in San Miguel East. Assay results are pending.

A 1,060 line km airborne electromagnetic survey, followed by a Lidar survey, was completed on Los Reyes in the first two weeks of March.

Relogging of all historic core holes continues with 58 of 89 holes being complete.

QA/QC Protocols and Sampling Procedures

Drill core at the Los Reyes project is drilled in predominately HQ size (63.5 mm), reducing to NQ or BQ size ranges (47.6 mm and 36.5 mm respectively) when required. Drill core samples are generally 1.50 m long along the core axis with allowance for shorter or longer intervals if required to suit geological constraints. Each entire hole is submitted for assay. Sample QAQC measures of unmarked certified reference materials (CRMs), blanks, and field duplicates as well as preparation duplicates are inserted into the sample sequence and make up ~8% of the samples submitted to the lab for each drill hole.

Samples are picked up from the project by Bureau Veritas and transported to their laboratory in Durango, Mexico, for sample preparation. Sample analyses is carried out by Bureau Veritas, with fire assay, including over limits fire assay reanalysis, completed at their Hermosillo, Mexico, laboratory and multi-element analysis in North Vancouver, British Columbia, Canada. Drill core sample preparation includes fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250 g split to at least 85% passing 75 microns (code PRP70-250).

Gold in diamond drill core is analyzed by fire assay and atomic absorption spectroscopy (AAS) of a 30 g sample (code FA430). Multi-element chemistry is analyzed by 4-Acid digestion of a 0.25 g sample split (code MA300) with detection by inductively coupled plasma emission spectrometer (ICP-ES) for 35 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd, Co, Cr, Cu, Fe, K, La, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, S, Sb, Sc, Sn, Sr, Th, Ti, U, V, W, Y, Zn, Zr).

Gold assay technique FA430 has an upper detection limit of 10 ppm. Any sample that produces an over-limit gold value via the FA430 technique is sent for gravimetric finish via method FA-530. Silver analysis by MA300 has an upper limit of 200 ppm. Sample with over limit silver are reanalyzed by fire assay with gravimetric finish (FA530).

Bureau Veritas is an ISO/IEC accredited laboratory. Drill core assay results range from below detection to 11.7 gpt gold and 953.0 gpt silver. Composite intervals use a cut-off grade of 0.2 gpt gold.

Qualified Person

Kerry Sparkes, P.Geo., Executive Vice President of Exploration, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

Los Reyes Gold and Silver Project

Los Reyes is a district-scale low sulphidation epithermal gold-silver project located in a prolific mining region of Mexico. Over $20 million in exploration, engineering and prefeasibility studies have been spent on the project over 2 1/2 decades by previous operators with development plans being held back due to declining gold prices. Historic data coupled with an existing and recently updated resource estimate has provided sufficient understanding to fast-track the project to production. However, there is substantial resource expansion upside based on open extensions of known deposits, multiple untested high priority exploration targets, and only 40% of the known structures systematically explored leaving 10 kilometres of untested strike length. Potential for significant growth of the resource remains strong.

Current Measured and Indicated pit-constrained oxide mineral resources include 19.8 million tonnes (‘mt’) containing 633,000 ounces of gold at 1.0 gpt and 16,604,000 ounces of silver at 26.2 gpt plus an additional 7.1 mt Inferred containing 179,000 ounces gold at 0.78 gpt and 6,831,000 ounces silver at 30 gpt.

About Prime Mining

Prime Mining, a TSX Venture 50 Company, is an ideal mix of successful mining executives, strong capital markets personnel and experienced local operators who have united to build a low cost, near-term gold producer at the historically productive Los Reyes project in Mexico. Prime Mining has a well-planned capital structure with significant team and insider ownership.

ON BEHALF OF THE BOARD OF DIRECTORS

Daniel Kunz

Chief Executive Officer

For further information, please contact:

Daniel Kunz

Chief Executive Officer and Director

Prime Mining Corp.

1307 S. Colorado Ave.

Boise, Idaho 83706

Telephone: 1-208-926-6379 office

email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Andrew Bowering

Executive Vice President and Director

Prime Mining Corp.

1507 – 1030 West Georgia Street

Vancouver, BC, V6E 2Y3

Telephone: (604) 428-6128

Facsimile: (604) 428-6430

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

Information set forth in this document may include forward-looking statements. While these statements reflect management's current plans, projections, and intents, by their nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond the control of the Company. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on these forward-looking statements. There is no assurance the transactions noted above will be completed on the terms as contemplated, or at all. The Company’s actual results, programs, activities, and financial position could differ materially from those expressed in or implied by these forward-looking statements.

© 2021