- Published: 12 August 2015

- Written by Kirill

In an astounding move China has just edited the alternative ending to the FED's movie "Mission Impossible: The Death Of Gold". China enters Currency War with a style of the best practise from "Art Of War": Yuan is devalued by 2% - by most on record! Gold is already celebrating and is up not only in Yuan terms, but in US Dollar as well to $1120 intraday high so far. Now we can better understand the big picture: why China was accumulating the record amount of gold and encouraged its citizens to do so as well. What a timing for the record buying of Gold just before this announcement and poor Hedge funds who was shorting gold on record, the short covering will be swift and explosive. This Special Op by China: "Yuan Sting" will have a very broad implications. In one move China is protecting its market from imports, stimulating domestic production and boosting its export power.

In an astounding move China has just edited the alternative ending to the FED's movie "Mission Impossible: The Death Of Gold". China enters Currency War with a style of the best practise from "Art Of War": Yuan is devalued by 2% - by most on record! Gold is already celebrating and is up not only in Yuan terms, but in US Dollar as well to $1120 intraday high so far. Now we can better understand the big picture: why China was accumulating the record amount of gold and encouraged its citizens to do so as well. What a timing for the record buying of Gold just before this announcement and poor Hedge funds who was shorting gold on record, the short covering will be swift and explosive. This Special Op by China: "Yuan Sting" will have a very broad implications. In one move China is protecting its market from imports, stimulating domestic production and boosting its export power.

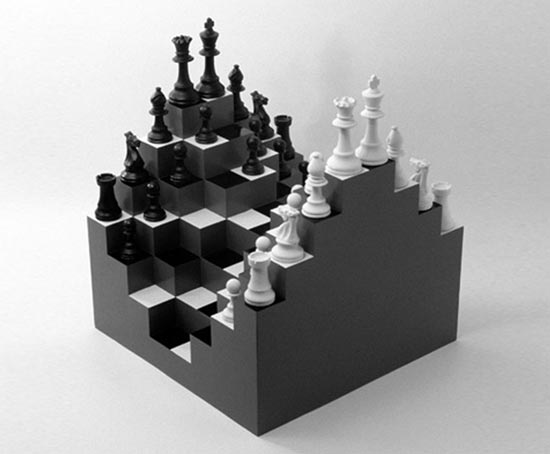

Live by TTIP - die by TTIP. The message is very clear. FED has now the great excuse never raise rates: "Just Because of China". Strong dollar will kill the anaemic recovery in U.S. and China welcomes outsourcing back. Whatever is the reason: AIIB vs TTIP, payback for the American Roller Coaster in the Chinese stock market or delay in SDR approval by IMF - the implications are very significant and we have geopolitics driving this chess game. Currency War is just another weapon of mass distraction.

Now I just have to spin my bellowed lithium as well here. In a brilliant state-level planed debut China has played out its own Clean Power Plan Twist: when nobody paid any attention world class lithium production facilities were built. Chinese lithium producers like Ganfeng Lithium are supplying Panasonic, who is supplying Tesla with lithium cells. Lithium supply chain is already under strain. Now BYD, Foxconn, Boston Power, LG Chem and A123 are building their own Megafactories to produce lithium batteries.

China is already controlling 75% of work-wide production capacity of Lithium Hydroxide. Companies like Ganfeng Lithium are securing supply of strategic commodities for this rEVolution and financing development of International Lithium J/V projects. Now, after the gambit move with Yuan "Sacrifice" devaluation, China will ignite production of lithium materials, batteries and EVs. Made In China is coming back in force and at the completely new technological level. Leapfrog into EV age past carbon economy and ICE cars is almost complete.

Will anybody care about it apart Trump's hair style here in the West? GMO boost created the great audience for the FB feeds, but what is next - are we ready for it? Elon Musk is almost alone against this coming tide and financial pundits are counting how much money he is losing on every car. At stake is Energy Independence and lithium is at the heart of it. Where will it be coming from? Who will be controlling the market and selling lithium batteries for all our EVs? By the way ICE Petrol cars are dead in the water according to Tesla's CTO. Be ready for this game to unfold very fast now.