Category: Submitted Articles

- Published: 14 July 2014

- Written by Kirill

Chile, Indonesia, USA, Australia and Canada together account for 80% of the world’s copper supply, and with the revived interest in the metal, many national companies are now making headlines with plans of acting to relieve demand pressures and ease supply shortfalls, signalling the potential turnaround and the major bottom in this mining cycle anticipated in the copper market.

Roughly half of all mined copper is used to manufacture electrical wire and cable conductors that are used in today's energy and communication technology applications. With both of these sectors rapidly advancing worldwide, it shouldn’t surprise market observers that the demand for copper is similarly on the rise.

Source: ICSG and IMF.

Source: ICSG and IMF.

Yet as copper gained ground, hitting a four month high at the beginning of July (London Metal Exchange) and peaking just above US $3.25/lb, many analysts had to re-rate their copper valuations, which were largely based on overblown fears of a dropping demand from China, it being the world’s largest base metal consumer. In actuality, Chinese copper demand continued to rise while the refined copper market ran into a deficit.

Source: IMF.

There is however a new drive for copper demand to be considered, a technological drive delivered by the global introduction of the electric car. Copper finds itself a prerequisite for every electric and hybrid car: it goes into the electric motors, the wiring and the battery power supply system. A complimentary factor, charging infrastructure, presents another component of the driving force developing the rapidly growing demand for copper cables and it's wiring market. The Chinese march against air pollution has catapulted electric car industry into the status of the strategic industry. In the recent news Beijing has announced building charging infrastructure with 1,000 fast charging stations and "electric cars ready" wiring mandate for all new residential communities.

Source: Tesla Motors.

Speaking of the U.S. and Europe Elon Musk continues to build the supercharger networks for Tesla Motors and talks with BMW and Nissan strongly insinuate that this technology could become the industry standard igniting the rapid development of the mass market for electric cars.

Copper demand is further bolstered by the development of high-speed railway network in China. This move is mirrored in the West with the UK and US flirting with the idea of developing their own high speed mass-transit systems, representing another strategic consideration for the industry which begins to feel somewhat constrained supply for all the projected demand.

A change in the copper market cycle was signified this spring with the carefully engineered by Chinese authorities acquisition by Minmetals Group of Las Bambas copper in Peru for US $6 billion from Glencore.Frik Els from Mining.com has reported that according to PwC Global Mining Leader John Gravelle this takeover is the sign of things to come, with companies further down the scale will also be impacted by the "Las Bambas" effect. It seems that the new M&A boom is just around the corner now:

"The size of the deal reflects Chinese belief in copper. And China's smaller and private mining operations take their guidance from the large state-owned enterprises," said Gravelle.

The National Development and Reform Commission, China's powerful economic planning agency, in May put into effect a new regime to govern overseas investment, making it much easier for domestic companies to make acquisitions and set up joint ventures abroad.

The so-called Order 9 scraps the approval process for deals worth less than $1 billion entirely, replacing it with a simple registration process, eases forex requirements and cuts out much of the bureaucracy. Mining.com"

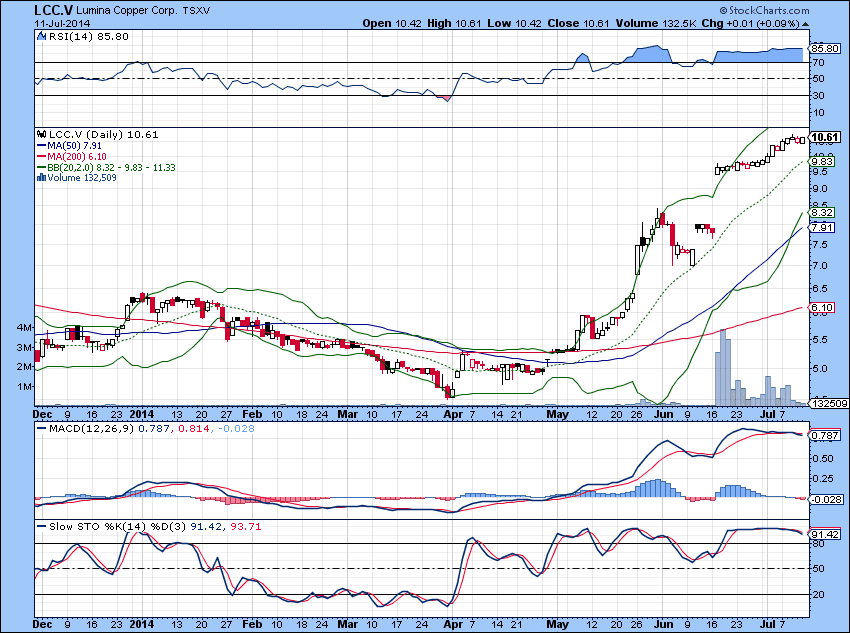

Interestingly, while many Wall Street market forecasters were caught off guard, Vancouver based TNR Gold Corp., a junior exploration company and Lumina Copper Ltd., a junior miner, planned to capitalise on the copper turnaround. Both companies pursued and secured their copper interests near the Andean Copper Belts in Argentina. For Lumina Copper Ltd. the foresight clearly paid off as the company recently announced they found a buyer for their Taca Taca project in the Salta Province (120 kilometres east of the Escondida, the world's largest producing copper mine). First Quantum Minerals Ltd. struck a deal to buy Lumina for CDN $470-million in cash and stock, and with the recent advance in copper prices Lumina Copper market cap is now close to CDN $500 million.

With revived interest in the commodity and that of the copper rich area,TNR Gold Corp. holds rights into the next obvious valuable asset for potential prospectors. The company retains a back-in right to northern part of Los Azules in San Juan, one of the largest undeveloped copper deposits in the world, currently owned and operated by McEwen Mining.

The back-in right is exercisable following the completion of a feasibility study and allows TNR to back-in for 25% of the northern part of the Los Azules property, which McEwen stated contains the largest share of the known resource at Los Azules. TNR’s advantage in this deal is that it does not assume any risks, nor does it need to raise any funds until a feasibility study is complete – which typically costs companies between $80-100 million. TNR has engaged PI Financial Corp., a leading independent investment dealer, to help market and sell TNR’s interest in this world-class, early-stage copper asset.

The back-in right is exercisable following the completion of a feasibility study and allows TNR to back-in for 25% of the northern part of the Los Azules property, which McEwen stated contains the largest share of the known resource at Los Azules. TNR’s advantage in this deal is that it does not assume any risks, nor does it need to raise any funds until a feasibility study is complete – which typically costs companies between $80-100 million. TNR has engaged PI Financial Corp., a leading independent investment dealer, to help market and sell TNR’s interest in this world-class, early-stage copper asset.

It is clear from looking at Lumina Copper’s stock, which went from CDN $3 to nearly CDN $11 in three months, that the market is slowly catching on to the real potential value of essential metal projects. Now it’s just a matter of patience and apt timing until the Los Azules project gains recognition for its formidable asset worth.

"The sale of our Back-in Right will provide the necessary liquidity and catalyst to all of our group of companies. Rob McEwen has done a great job as Operator developing this project and now Los Azules is at the top of the list of the best copper projects in the world available for sale, according to PI Financial! I would recommend to contact Jim Mustard VP at PI Financial to get more information about Los Azules Copper project and our Back-In Right Asset. Read more."